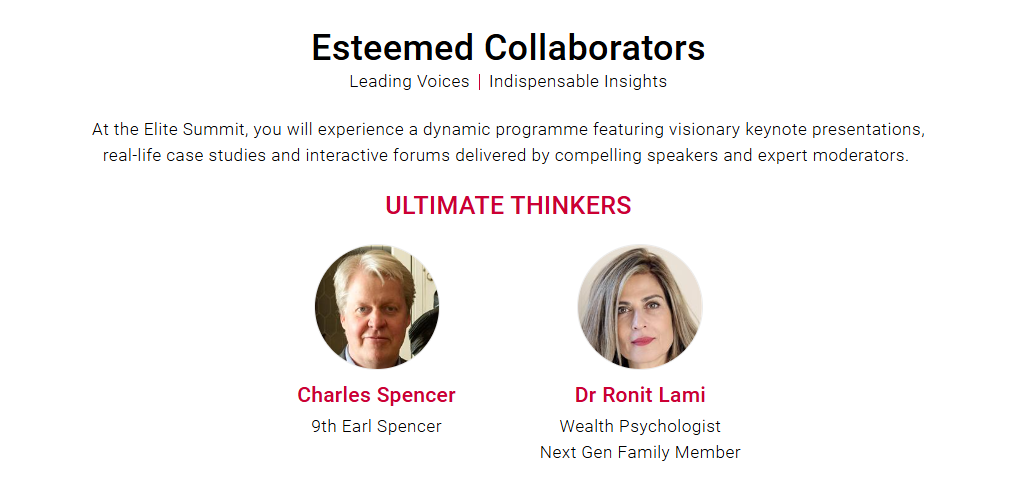

Featuring Dr. Ronit Lami & Next Gen Family Member alongside Todd Benjamin, Former Financial Editor, CNN International

I’m thrilled to share an upcoming highlight of my professional journey—an engaging fireside chat with Todd Benjamin, set in the beautiful backdrop, in the same event with the esteemed Charles Spencer – 9th Earl Spencer. This event promises to delve deep into the complex world of wealth psychology, a topic close to my heart and crucial for ultra-high-net-worth (UHNW) families navigating the intricacies of wealth transfer across generations.

During this fireside chat with Todd Benjamin, I will discuss:

- Identifying various emotional barriers and exploring the psychological factors that often hinder effective communication and decision-making regarding wealth and its transfer within families.

- Improving family dynamics while sharing strategies for fostering open dialogues about money, inheritance, and the values that shape family legacies, thereby promoting stronger relationships among family members.

- Providing insights into personalized approaches that address the unique challenges each family faces, ensuring that wealth is not just transferred but also understood and appreciated by future generations.

Unveiling Emotional Barriers and Psychological Dynamics:

In this conversation, I will explore the emotional challenges and psychological factors that often obscure clear communication and effective decision-making within family wealth management. Understanding and addressing these emotional barriers are vital for facilitating smoother transitions and ensuring that wealth serves as a tool for unity rather than division.

Strengthening Family Dynamics:

I am passionate about helping families enhance their communication about sensitive issues like money, inheritance, and the values that shape their legacies. During the chat, I’ll share strategies that foster open dialogues, promoting a culture of transparency and mutual respect. These approaches are designed to strengthen family bonds and ensure that every member feels acknowledged and valued.

Tailoring Strategies to Unique Family Needs:

Recognizing the uniqueness of each family, I will discuss how bespoke strategies can be particularly effective. These personalized plans are crafted to resonate with and respect the specific needs and dynamics of each family, ensuring that the wealth transfer is not only efficient but also cherished by each succeeding generation.

Practical Insights and Tools:

Attendees will gain practical insights and tools that can be immediately applied to enhance their family wealth management practices. From conflict resolution techniques to integrating younger family members into wealth discussions early, the session will equip families with the necessary skills to manage their wealth with confidence and foresight.

The Significance of This Dialogue:

Managing wealth in a way that enriches relationships and fosters growth across generations is both an art and a science. This fireside chat is designed to illuminate the path for families looking to harness their wealth for positive generational impact.

I don’t often share the stage in such a public manner, but the importance of these discussions and the opportunity to speak in the same event as Charles Spencer have compelled me to step forward. Join Todd Benjamin and me as we unpack these vital issues, providing both theoretical understanding and actionable advice.

I’m excited to guide you through these complex dynamics. This event is more than just a conversation; it’s a stepping stone to a harmonious and prosperous generational wealth transition.

Secure your spot and be part of this transformative experience!

Ready to redefine how your family interacts with wealth? Contact me for personalized guidance and empower your family’s financial future starting today.